Few founders in India have seen the swings —- the ups and the downs — that Vijay Shekhar Sharma has seen with Paytm. The latest high is the company’s turn to profitability in the first quarter of FY26.

It’s a moment that vindicates the belief that Sharma had espoused in mid 2024 when Paytm was still stuck in the weeds. Since then, Paytm has gone through its most significant transformation in years.

The fintech giant reported a consolidated net loss of INR 840 Cr after the June quarter in 2024, but one year later it is in the black with a profit ofINR 122.5 Cr in Q1 FY26. What exactly changed in the past 12 months?

It let go of thousands of employees, pressed the accelerator on AI and even scaled back by shedding prominent brands like Paytm Insider. And as Sharma emphasised with each quarterly earnings call, Paytm was focussing on payments again — doubling down on its core identity.

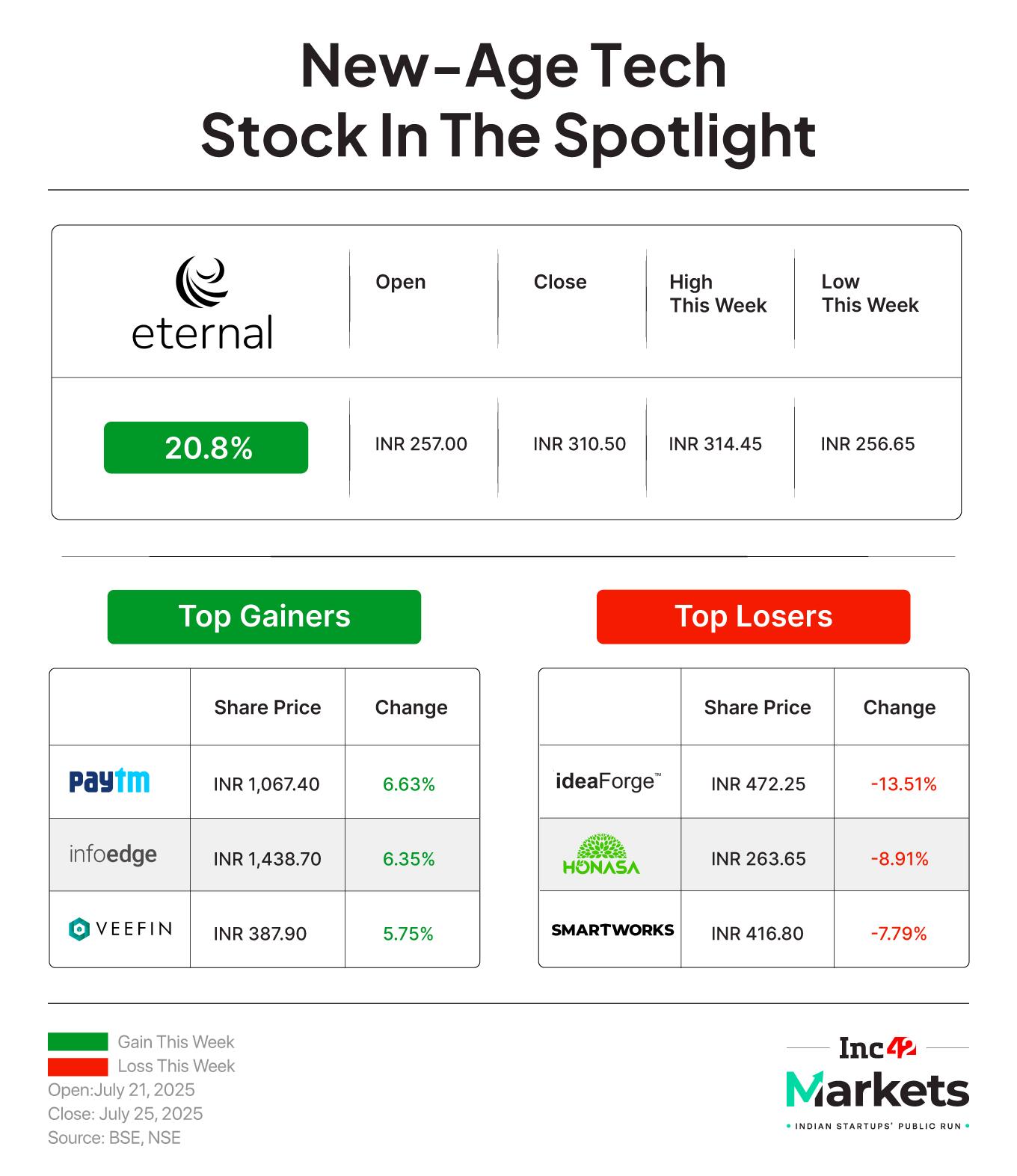

The market’s reaction was euphoric after the Q1 results. Brokerage firm Jefferies, which had maintained a cautious ‘hold’ rating, upgraded Paytm to a ‘buy’, significantly raising its target price. The stock, which was struggling for momentum, surged to a new 52-week high, a clear vote of confidence from investors who had been waiting for a tangible sign of a turnaround.

Let’s unpack how Paytm got there.

The Big DeclutterSometime around 2018, Paytm realised it had the opportunity to become India’s WeChat or Alibaba. But the super app thesis was riddled with holes in the Indian context.

The payments app expanded into a plethora of services, from movie ticketing to ecommerce, but this diversification had come at a cost. The regulatory crackdown on Paytm Payments Bank in early 2024 was a wake-up call, a moment of reckoning. The result was the big declutter of 2024.

Sharma shelved Paytm’s super app ambitions, and the focus was brought back to the core of the business: payments.

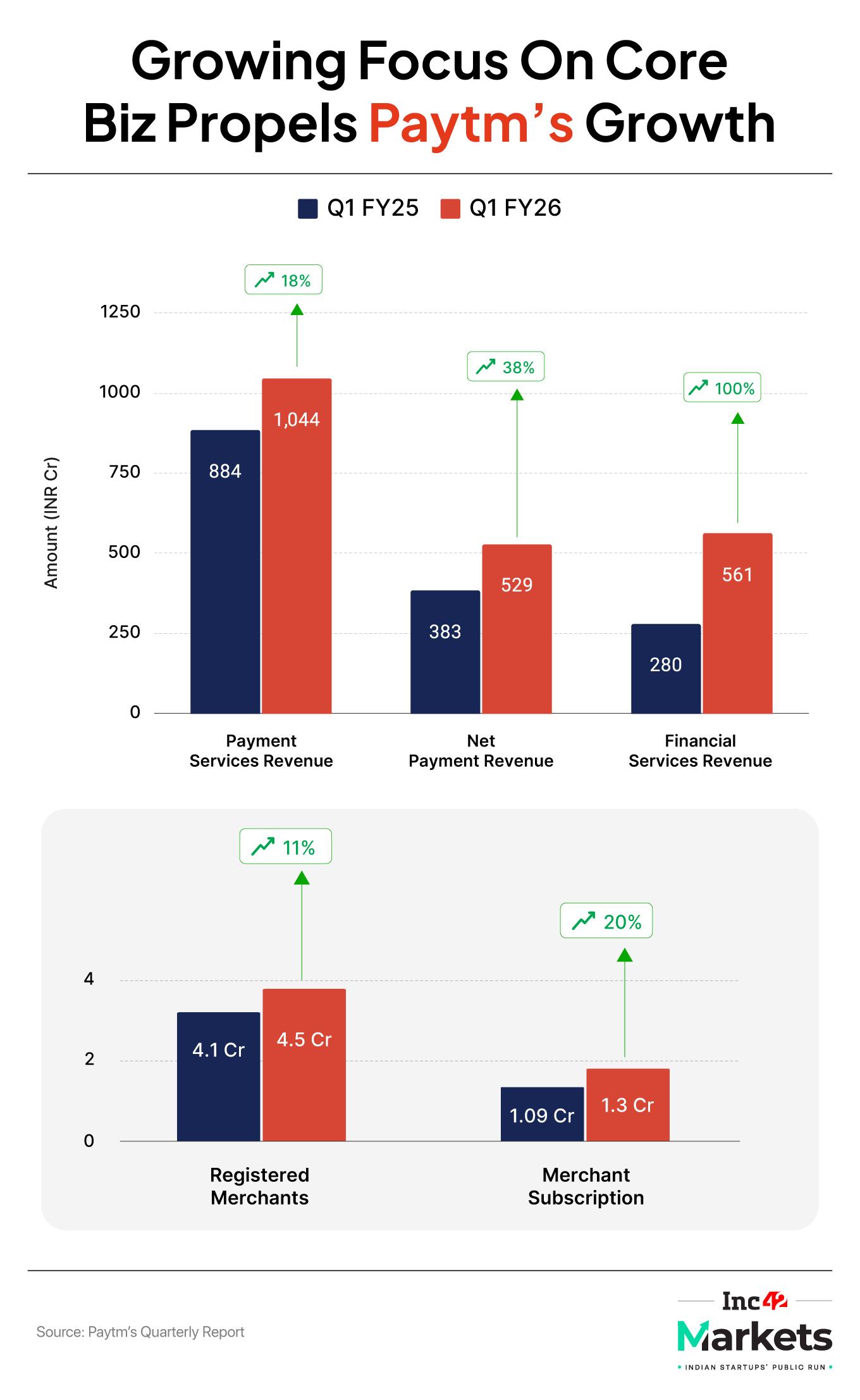

The renewed focus on payments became the bedrock of the company’s revival. Paytm doubled down on its merchant network, the backbone of its ecosystem, even though lending was slowing down.

The Paytm Soundbox was also revamped in this push, as the merchant subscription base grew to 1.3 Cr in Q1 FY26, a 20% year-on-year increase. This wasn’t just about acquiring merchants; it was about creating a sticky ecosystem, providing them with other services.

Like lending. The company scaled down its personal loan business, which was facing RBI scrutiny and market stress. While today, Paytm is largely a loan distributor, the core focus is on the merchant loans vertical, and distribution revenue doubled year-on-year in Q1 FY26.

The other pillar in this turnaround story was the company’s cost cutting in terms of human resources and streamlining the operational structure after the exit of Bhavesh Gupta in May 2024. Since then, CEO Sharma has called for an “AI-first” approach within Paytm.

The company said it leveraged AI to automate a wide range of processes, from merchant onboarding to fraud detection. This “AI-led operating leverage” resulted in a significant reduction in indirect expenses. “For the past year and a half, we’ve been deeply committed to embedding AI throughout the organisation. Every customer-facing product and internal process is AI-driven, showcasing our dedication to innovation,” Paytm CFO Madhur Deora said at the earnings call, adding that every product and internal process at Paytm will be “AI-first”.

Besides merchant onboarding, AI plays a role in fraud and risk management, transaction monitoring and in customer support.

The next focus is beyond the borders of India. The company is looking at itself as a financial services technology player rather than a payments app in new markets like the UAE, Saudi Arabia, and Singapore. This is part of Paytm’s push to become a tech company in the financial services industry and not the other way around.

Can The Profits Keep Going?The challenge for Vijay Shekhar Sharma now is about sustaining the profitability. The debate around the merchant discount rate (MDR) on UPI transactions also presents a potential upside for Paytm in the long run, with even the RBI dropping hints about UPI transactions becoming chargeable soon.

In the past, Sharma has claimed that MDR would intensify competition, while being a significant revenue opportunity, so this may not exactly be the leverage that payment companies hope for. It may increase spending on UPI for these platforms.

Merchants need to be the centre of Paytm’s focus; it’s the segment that’s showing the most potential for scale and sustainable growth in India. Competitive intensity is not about to ease up though.

If the company’s ‘declutter’ in the past year shows anything, it’s that Paytm now has a certain agility that it seemed to have lacked when the Paytm Payments Bank-led problems had derailed its business.

There will be other challenges, as Sharma will himself acknowledge, and keeping the Paytm profit machine running will be just as important as getting to profits itself. The Q1 showing was great, Paytm still has to stick the landing.

Blinkit Outweighs Zomato In Eternal’s EmpirePaytm’s Q1 results were not the only surprise this week among listed companies.

When Zomato changed its name to Eternal, it signified a shift in the company’s strategy: Zomato was no longer the focus.

This was inFebruary 2025. Come July, a cursory glance at Eternal’s (earlier Zomato’s)Q1 FY26 financial statement reveals how Eternal is now more Blinkit than Zomato. This extends to revenue, the growth narrative and the company’s future investments.

Exhibit A: For the first time, Blinkit’s net order value (NOV) has surpassed food delivery’s NOV for a full quarter.

The indications were always there. A little over a year ago, CEO Deepinder Goyal himself said that Blinkit would be a bigger business than Zomato’s food delivery business.

Take a deep dive

Markets Watch: New IPOs, Deals & More- ideaForge’s Weak Q1: The listed drone tech startup’s consolidated operating revenue crashed 85% to INR 12.8 Cr in Q1 FY26 from INR 86.2 Cr in the year-ago quarter. Meanwhile, the company posted a net loss of INR 23.6 Cr as against a net profit of INR 1.2 Cr in Q1 FY25.

- MakeMyTrip’s Profitable Q1: The Nasdaq-listed OTA reported a 23% jump in its profit to $25.8 Mn in Q1 FY26 compared to $21 Mn in the year-ago quarter. However, revenues rose a meagre 5.6% YoY to $268.9 Mn during the quarter under review.

- IndiQube IPO Day 2: The workspace solutions provider’s public issue was subscribed 2.5X on the second day, driven by strong demand from retail investors. On Day 2, the IPO received cumulative bids for 4.3 Cr shares against 1.71 Cr shares on offer.

- PW’s IPO Gets SEBI Nod: Just four months after filing its DRHP via confidential route, PhysicsWallah has received the markets regulator’s approval for its IPO. As per reports, the edtech major is looking to raise $531 Mn via its public listing at a $3.7 Bn valuation.

- KreditBee Readies For IPO: In preparation for its market debut, the fintech startup’s board has approved a proposal to convert the company into a public entity. In addition, the company has received RBI’s nod to merge the group’s technology arm into the NBFC subsidiary

The post Can Paytm Stick The Landing After Q1 Display? appeared first on Inc42 Media.

You may also like

Brazil chooses one of its poorest regions for UN climate talks, here's why

BBC and ITV make huge Lionesses announcement ahead of World Cup 2027

Christian Horner texts revealed by Red Bull replacement as sacked boss shows true colours

Video: PV Sindhu Performs Bonalu Festival Rituals In Hyderabad, Days After Defeat To Unnati Hooda In China Open 2025

Royal Mail scraps major delivery service from today for millions of UK homes